Talk to an Expert

201-705-6603

-

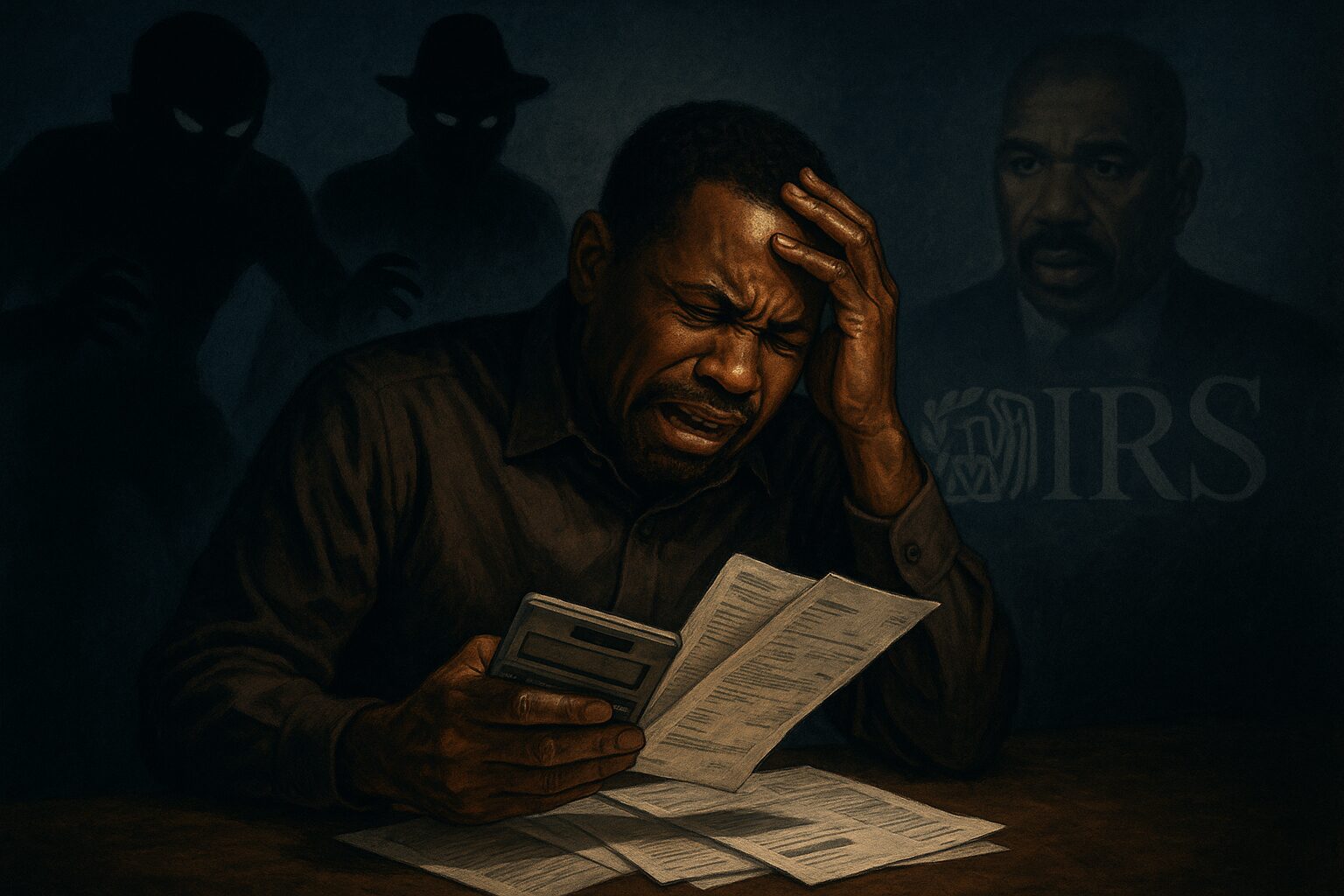

How to Avoid a $22M Tax Fraud Nightmare Like Steve Harvey

How Business Owners, Entrepreneurs, and 1099 Earners Can Protect Themselves Did you know? In early 2025, the IRS stopped over $908 million in fraudulent tax refunds, up from $262 million a year prior—a staggering rise in identity theft, preparer scams, 1099 fraud, and business-targeted schemes. Business owners, entrepreneurs, and gig workers (anyone getting 1099 income) are specifically…

Latest Post

- Turbocharge Your Deal Closure: Unlock Contract Mastery with PandaDoc

- Simplify Expense Tracking and Tax Prep with Shoeboxed: Your Secret Weapon for Financial Clarity

- Revolutionizing Bookkeeping: How QuickBooks Automation Empowers Entrepreneurs

- Master Your Finances: QuickBooks Tips for Entrepreneurs Who Dread Bookkeeping

- Secure Your Success: Password Security Essentials for Entrepreneurs with 1Password