How Business Owners, Entrepreneurs, and 1099 Earners Can Protect Themselves

Did you know? In early 2025, the IRS stopped over $908 million in fraudulent tax refunds, up from $262 million a year prior—a staggering rise in identity theft, preparer scams, 1099 fraud, and business-targeted schemes. Business owners, entrepreneurs, and gig workers (anyone getting 1099 income) are specifically vulnerable due to the complexity of their finances and the increased use of preparers or bookkeepers.

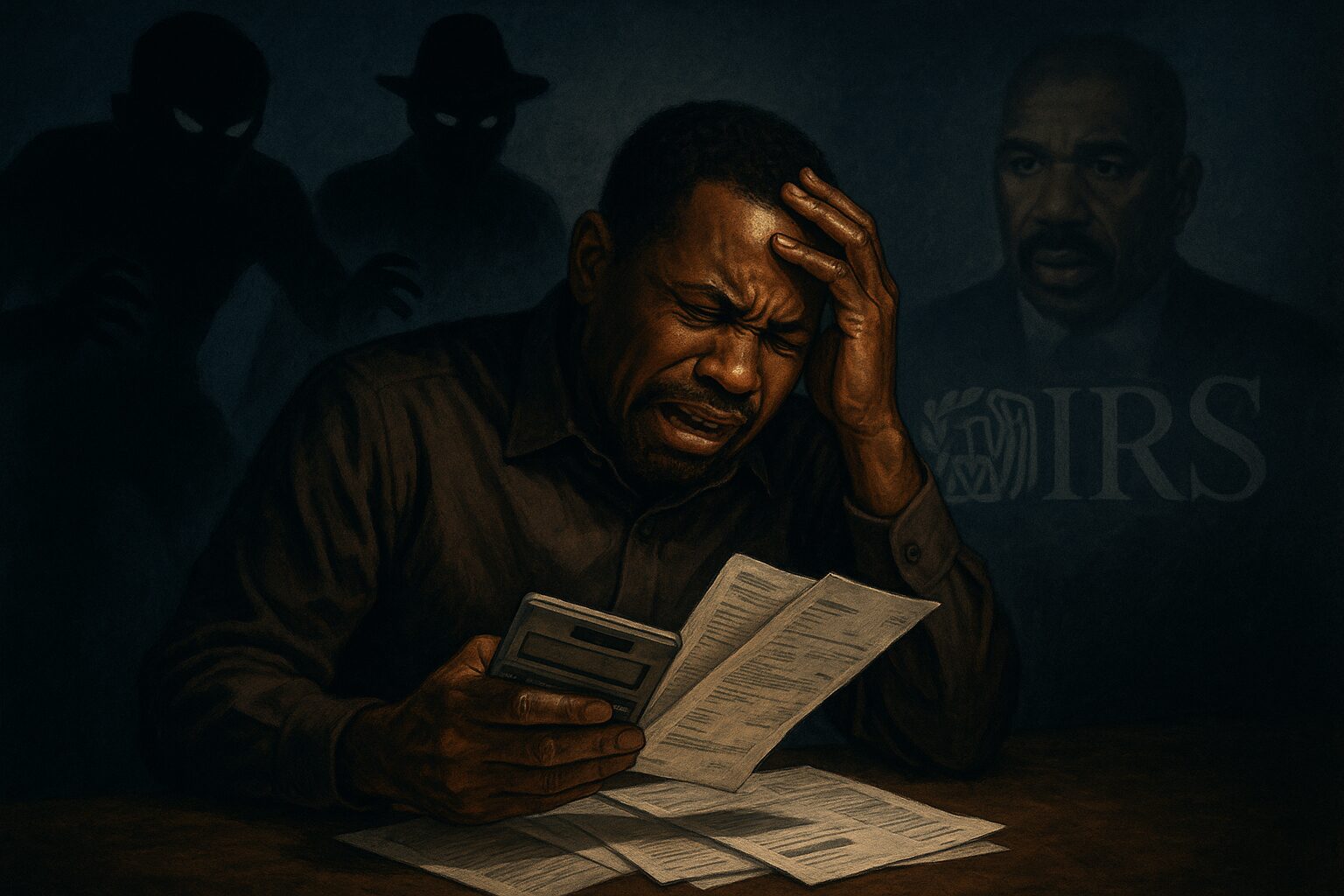

Below is an expanded, actionable guide—featuring the latest IRS stats and a practical, downloadable checklist—to help you avoid a disaster like Steve Harvey’s accountant betrayal.

🚨 2025 IRS Tax Fraud Stats & Red Flags

- Fraudulent Returns Identified: 58,276 returns (worth $916.3 million) flagged and nearly all stopped as fraudulent by February 2025.

- Dirty Dozen Scams: IRS warns businesses about “ghost preparers,” fake/overstated 1099 filings, overstated withholding, and phishing schemes targeting EINs and sensitive payroll data.

- 1099 & Small Biz Fraud: Common 2025 schemes include pretending to have more 1099 income or withholdings to grab large refunds, business email compromise, and “new client” phishing attacks on accountants.

- Pandemic-Related Tax Crimes: $8.9 billion in COVID-relief tax fraud cases and more than 1,600 indictments since 2020.

Step-by-Step: Protect Your Business or Freelance Income from Tax Fraud

1. Vet Your Tax Professional Thoroughly

- Only use preparers with a valid IRS PTIN.

- Check for credentials: CPA, EA, or tax attorney status.

- Demand the preparer signs your tax return—ghost preparers are a huge red flag.

- Ask for client references and search online reviews.

2. Demand & Maintain Detailed Documentation

- Keep signed copies of all tax returns and IRS-provided filing receipts or acknowledgments.

- Never send funds for tax payments directly to your preparer—always pay the IRS or state directly when possible.

3. Directly Monitor IRS Business/Personal Tax Accounts

- Set up your IRS online taxpayer account. Regularly review your transcripts and balances.

- For businesses, routinely confirm payroll tax and business tax account standing with the IRS.

4. Increase Security & Internal Controls

- Require two-person verification for all financial changes or wire transfers—never let a bookkeeper or CPA have unchecked access to funds.

- Use encrypted document sharing and enable MFA across all financial and payroll accounts.

- Train employees on phishing, spear phishing, and business email compromise attempts.

5. Verify Every 1099, W-2, and EIN

- Confirm you receive all 1099s and W-2s sent under your business or SSN. Contact issuers if any are missing.

- Regularly review your EIN’s online status and immediately update it with any business changes.

- Never claim credits, refunds, or withholdings for which you do not have clear, legitimate documentation.

6. Respond Quickly to IRS or State Letters

- The IRS never initiates contact by email, text, or social media. All official notices arrive via U.S. Mail.

- Open every IRS/state tax letter promptly and seek help immediately for anything unexpected.

7. File Early and Review Everything

- Filing early lowers your risk of scammers filing a return in your name first.

- Double-check all preparer entries, especially income and withholding amounts.

Downloadable Checklist: “Tax Fraud Protection for Business Owners & 1099 Earners”

Copy and use this as your annual personal/business checklist:

TAX FRAUD PROTECTION CHECKLIST

☐ Use only credentialed, signing tax preparers (CPA, EA, Attorney; must provide PTIN)

☐ Get a copy of every filed return and the IRS e-file acknowledgment

☐ Pay taxes directly to IRS/state; never to your preparer personally

☐ Review IRS and state tax accounts at least quarterly for red flags or missing payments

☐ Confirm all 1099s, W-2s, and EIN records match your business info each year

☐ Require multi-factor authentication for banking, accounting, and payroll platforms

☐ Educate your team on phishing, scams, and social engineering

☐ Never authorize last-minute payment or document changes via email only—always call or verify in person

☐ Safely store encrypted copies of all returns, receipts, and IRS correspondence

☐ Respond immediately to any IRS/state mail—and always independently confirm requests

☐ File business and personal returns early each year

☐ Report any suspicious preparer or tax scam to the IRS immediately (Form 14157/14242)

Keep this checklist with your tax organizer and review each item every tax year!

Final Thoughts for Business Owners, Entrepreneurs, and 1099 Earners

Steve Harvey’s story proves that oversight is everything when trusting others with your money. In 2025, the IRS is catching more tax fraud than ever, but scammers are constantly evolving. Whether you’re self-employed, running payroll, or juggling multiple 1099s:

- Stay informed

- Use official IRS tools

- Demand transparency

- Guard your EIN like gold

- Take control—never abdicate tax responsibility.

Taking these steps ensures your hard-earned income, your reputation and your freedom are protected from the ever-growing threat of tax fraud.

Leave a Reply

You must be logged in to post a comment.