Ever been told you can start fresh with a new credit identity using a CPN?

Sounds like a dream come true for anyone with bad credit.

But here’s the truth: that so-called Credit Privacy Number could land you in federal prison.

In this article, we’ll break down:

- What a CPN is (and what it’s not)

- Why using one is illegal

- The top scams around CPNs

- What you can do legally to rebuild credit

- How to use trusted tools like Refresh to take the right steps forward

Let’s pull back the curtain on one of the most dangerous credit scams circulating the internet today.

What Is a CPN?

A CPN (Credit Privacy Number or Credit Profile Number) is a 9-digit number falsely marketed as a substitute for your Social Security Number (SSN) when applying for credit.

It’s often sold as:

- A way to protect your privacy

- A “clean slate” for your credit

- A method to hide from past credit mistakes

💡 Key Point: There is NO government-issued “CPN” that legally replaces your SSN.

Who’s Selling CPNs?

Scammy credit repair companies and fraudsters promote CPNs as:

- “Legal alternatives” to SSNs

- “Issued by the government”

- “Used by celebrities and politicians to protect privacy”

They charge hundreds or even thousands of dollars for these numbers — sometimes even more if bundled with a fake identity profile.

But here’s the cold truth:

🔥 99% of CPNs are either made up or stolen SSNs — often from children, inmates, or the deceased.

Is a CPN Legal?

Let’s be clear:

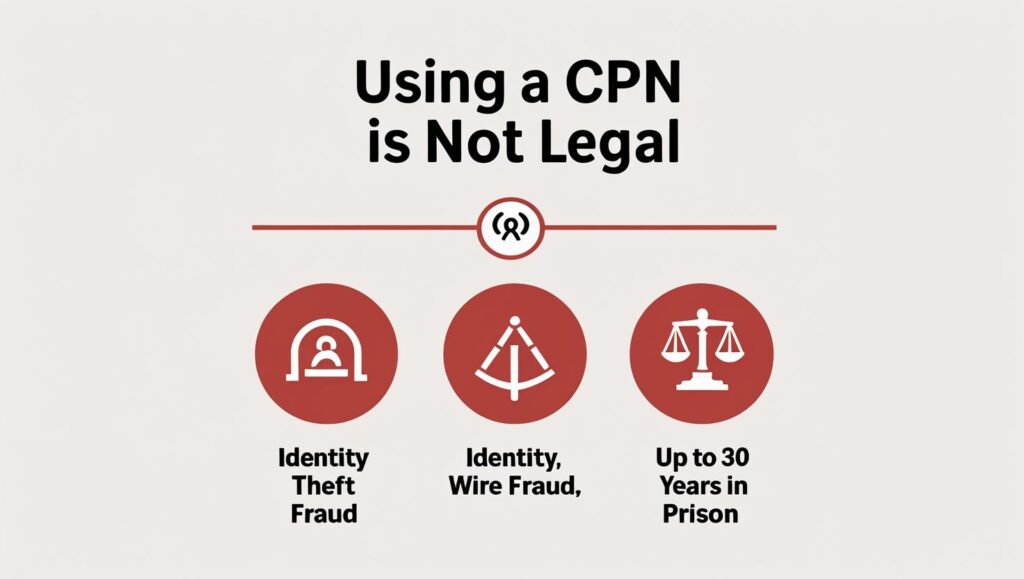

Using a CPN on a credit or loan application is illegal.

According to the Federal Trade Commission (FTC) and Social Security Administration (SSA):

- There is no legitimate legal basis for CPNs.

- Using one in place of an SSN may constitute identity theft, wire fraud, and conspiracy to commit fraud.

What Laws Are Violated?

Here are a few statutes that CPN misuse may violate:

- 18 U.S. Code § 1028 – Identity Theft

- 18 U.S. Code § 1014 – False Statements on Credit Applications

- 18 U.S. Code § 1343 – Wire Fraud

The penalties?

- Fines up to $250,000

- Up to 30 years in federal prison

Why People Fall for the CPN Scam

Here are some common reasons why people risk it:

- Desperation: They’re drowning in debt or have terrible credit.

- Ignorance: They don’t know the law and believe the seller.

- Promises: CPN promoters use persuasive language like:

- “Totally legal”

- “Used by celebrities”

- “Protect your identity”

But you’re not protecting yourself — you’re signing up for fraud.

Real-World Example: CPN Scam Busted

In 2021, the DOJ prosecuted a credit repair ring that sold thousands of CPNs to unsuspecting victims. Customers used them to apply for credit cards, loans, and apartments.

The result? Multiple people were indicted for identity theft, wire fraud, and conspiracy — both the sellers and the users of CPNs.

Even “not knowing” the number was stolen didn’t stop the charges.

Common Warning Signs of a CPN Scam

- You’re asked to use a different number than your SSN

- The number starts with “000” or “9” (common with fake SSNs)

- You’re told to lie on applications

- You’re instructed to build a “new credit file”

- The seller wants cash payments via Zelle, CashApp, crypto, etc.

⚠️ If someone is selling you a CPN, report them immediately to the FTC.

What You Should Do Instead of Using a CPN

✅ 1. Pull Your Free Credit Report

Start at AnnualCreditReport.com. This is the only government-authorized site where you can check your report from:

- Equifax

- Experian

- TransUnion

✅ 2. Dispute Errors Legally

Many people have inaccurate info hurting their score. You can dispute incorrect:

- Late payments

- Collections

- Inquiries

- Missed accounts

✅ 3. Use Credit-Building Tools Like Refresh

Rather than risking prison with a CPN, use a legitimate and smart option: Refresh.

With Refresh, you can:

- Build credit history using secured lines

- Track your score improvement over time

- Get tools tailored to your credit needs

✨ Rebuilding your credit doesn’t have to be risky.

Use Refresh — a smarter, safer way to get back on track.

✅ 4. Use Secured Credit Cards

These cards require a cash deposit but help you build real credit tied to your SSN. Look into:

- Discover it® Secured

- Capital One Platinum Secured

✅ 5. Get Help From Certified Credit Counselors

Look for help from:

- National Foundation for Credit Counseling (NFCC)

- Local non-profits

- HUD-approved housing counselors

How This Affects You If You’re a Business Owner

Using a CPN in a business credit application can:

- Trigger an IRS audit

- Disqualify you from SBA loans

- Void any personal guarantees

You’re better off building your EIN credit with DUNS numbers and vendor lines the legal way.

How does using a CPN affect my business if I am a business owner?

Using a CPN in a business credit application can trigger an IRS audit, disqualify you from SBA loans, and void personal guarantees. It is safer to build business credit legally through EIN credit, DUNS numbers, and vendor lines.

What legal steps can I take to rebuild my credit instead of using a CPN?

You can pull your free credit report from AnnualCreditReport.com, dispute inaccuracies, use legitimate credit-building tools like secured credit cards or services such as Refresh, and seek help from certified credit counselors.

What are the common scams associated with CPNs?

Scammers often sell fake or stolen SSNs claiming they are CPNs, and promote them as legal privacy tools or ways used by celebrities, but most CPNs are made up or stolen SSNs from vulnerable populations.

Why is using a CPN considered illegal?

Using a CPN in place of your SSN on credit applications violates federal laws such as identity theft and wire fraud statutes, and may result in severe penalties including fines and imprisonment.

What is a CPN and is it legitimate?

A CPN (Credit Privacy Number) is a 9-digit number falsely marketed as a substitute for your Social Security Number (SSN). There is no government-issued legitimate CPN, and using one is illegal.