Managing 1099-K forms as a small shop owner just became significantly easier in 2025. Thanks to the One Big Beautiful Bill Act, the reporting threshold has reverted from the planned $2,500 back to $20,000 plus 200 transactions, providing crucial relief for thousands of small businesses across America.

This comprehensive guide walks you through exactly how to handle 1099-K requirements in 2025, from understanding new thresholds to implementing foolproof bookkeeping systems that keep your small shop compliant and profitable.

Understanding 1099-K Forms for Small Shops

What is a 1099-K Form?

The 1099-K form reports payment card transactions and third-party network payments your small shop received during the tax year. Think of it as a summary of your digital sales through:

- Credit and debit card processors (Square, Stripe, PayPal Here)

- Online marketplaces (Etsy, eBay, Amazon Handmade)

- Payment apps used for business (PayPal, Venmo Business, Cash App)

2025 Threshold Changes: What Small Shops Need to Know

Current Requirements (2025):

Previous Timeline (Now Canceled):

The IRS had planned to lower thresholds dramatically:

- 2025: $2,500 (canceled)

- 2026: $600 (canceled)

This reversal means most small shops won’t receive 1099-K forms unless they process significant volume, reducing paperwork burden while maintaining essential tax compliance.

Small Businesses Categories Most Affected

Retail and Boutique Shops

Physical Storefronts:

- Card processor volume: Square, Clover, Shopify POS transactions

- Online sales integration: Website and marketplace sales

- Seasonal considerations: Holiday sales pushing over thresholds

Typical Scenarios:

- Local boutique with $15,000 annual card sales: No 1099-K required

- Gift shop with $25,000 in 180 transactions: No 1099-K required

- Busy retail shop with $22,000 in 220 transactions: 1099-K required

Handmade and Craft Businesses

Etsy and Marketplace Sellers:

- 2025 threshold: $20,000 + 200 transactions (reverted from $5,000)

- Multi-platform sales: Combined reporting across platforms

- Craft fair integration: Cash vs. digital payment tracking

Bookkeeping Priorities:

- Track materials costs for Cost of Goods Sold calculations

- Document time spent for business vs. hobby determination

- Maintain inventory records for tax purposes

Service-Based Small Shops

Professional Services:

- Consulting and coaching: Digital payment tracking

- Repair services: Cash vs. card payment ratios

- Beauty and wellness: Appointment-based payment systems

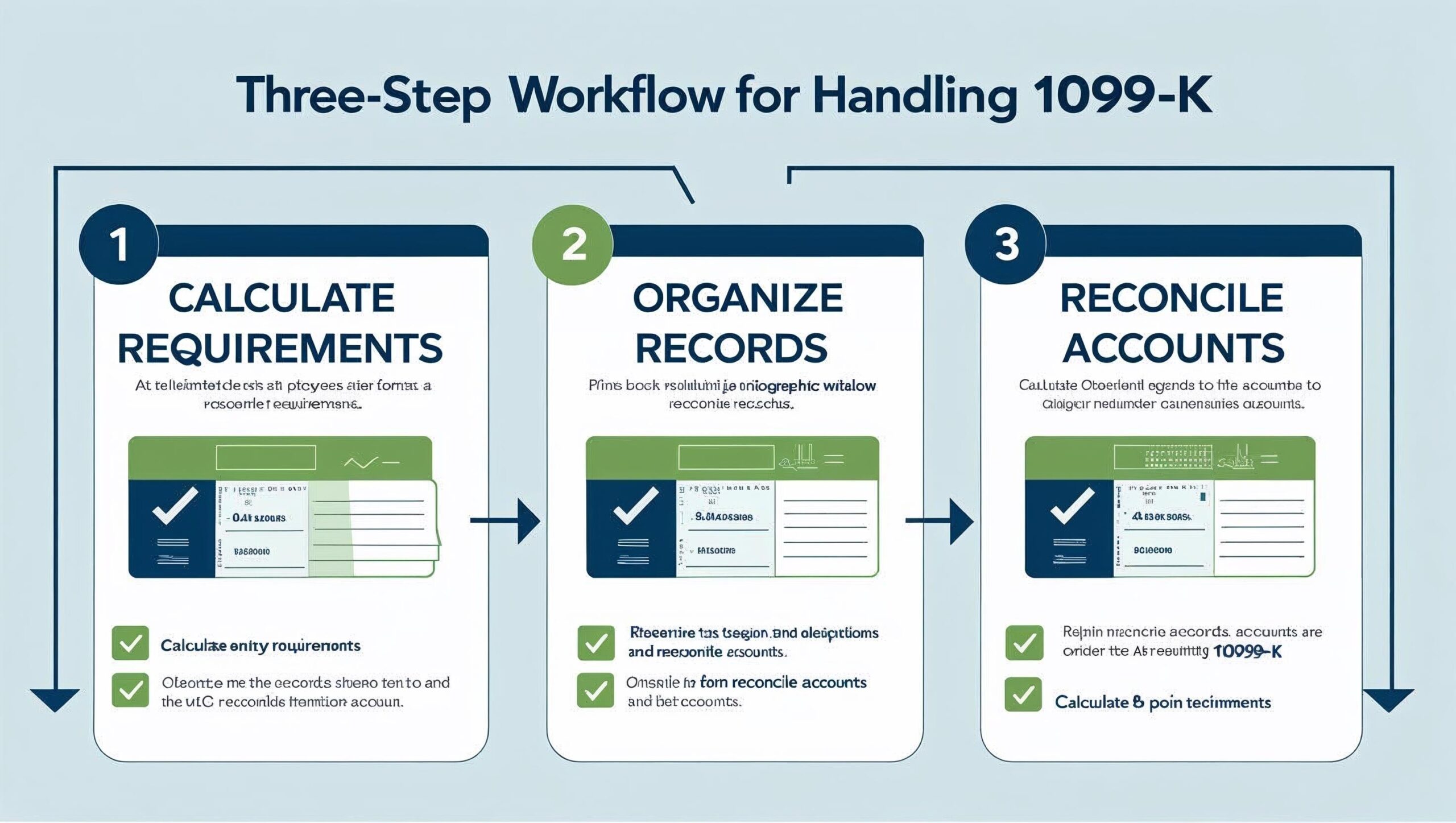

Step-by-Step 1099-K Handling Process

Step 1: Determine Your Reporting Requirements

Calculate Annual Totals:

Total Card/Digital Payments in 2025: $_______

Total Number of Transactions: _______

Threshold Met? _____ (Yes if both >$20,000 AND >200 transactions)

Platform-by-Platform Tracking:

- PayPal Business: Check annual summary

- Square: Review dashboard analytics

- Etsy: Download payment history

- Shopify: Export transaction data

- Other platforms: Gather year-end summaries

Step 2: Organize Your Records

Essential Documentation:

- All 1099-K forms received (typically by January 31)

- Bank deposit records matching form amounts

- Platform payment summaries for cross-reference

- Refund and chargeback documentation

Common Discrepancies to Watch:

- Timing differences: Payments received vs. deposited

- Refunds and returns: May not be reflected on 1099-K

- Processing fees: Often not deducted on forms

- Multiple business accounts: Ensure all forms are collected

Step 3: Reconcile 1099-K with Your Records

Monthly Reconciliation Process:

- Download monthly statements from all payment processors

- Cross-reference with bank deposits

- Document any discrepancies immediately

- Track refunds and chargebacks separately

Year-End Reconciliation Checklist:

- Total 1099-K amounts = $______

- Total recorded income = $______

- Difference explained by: ______

- Supporting documentation attached

Small Business Bookkeeping System

Daily Operations

Point-of-Sale Integration:

- Cash sales tracking: Manual entry into accounting system

- Card transaction recording: Automatic sync where possible

- Mixed payment handling: Split transactions documentation

Expense Management:

- Receipt photography: Immediate capture using apps

- Vendor payment tracking: Check and electronic payments

- Inventory purchase documentation

- Business mileage logging

Weekly Review Process

Sales Analysis:

- Review weekly sales totals across all channels

- Identify top-performing products/services

- Track seasonal trends and patterns

- Monitor payment processing fees

Cash Flow Management:

- Calculate net weekly income (sales minus expenses)

- Review accounts payable (upcoming bills)

- Check inventory levels and reorder needs

Monthly Financial Review

Profit and Loss Assessment:

Monthly Revenue: $______

Cost of Goods Sold: $______

Gross Profit: $______

Operating Expenses: $______

Net Profit: $______

Tax Preparation:

- Set aside tax percentage (typically 25-30% of profit)

- Review deductible expenses by category

- Update estimated tax payment calculations

Essential Tax Deductions for Small Shops

Cost of Goods Sold (COGS)

Retail Shops:

Handmade/Craft Businesses:

Operating Expenses

Physical Location:

- Rent or mortgage interest (business portion)

- Utilities (business percentage)

- Business insurance premiums

- Security systems and monitoring

Digital Operations:

- Website hosting and domain costs

- E-commerce platform fees (Shopify, Etsy, etc.)

- Payment processing fees

- Marketing and advertising expenses

Professional Development

Small Shop Growth:

- Trade show attendance and booth fees

- Professional association memberships

- Business education and training courses

- Networking event costs

Quarterly Tax Strategy

Estimated Tax Payments

Payment Schedule for 2025:

- Q1: Due April 15, 2025

- Q2: Due June 16, 2025

- Q3: Due September 15, 2025

- Q4: Due January 15, 2026

Calculation Method:

Quarterly Net Profit: $______

Self-Employment Tax (15.3%): $______

Income Tax (12-22% typical): $______

Total Estimated Payment: $______

Cash Flow Planning

Seasonal Business Considerations:

- High-season preparation: Extra inventory, staffing

- Low-season planning: Reduced expenses, maintenance

- Holiday sales impact: Fourth quarter tax implications

Common Small Shop 1099-K Mistakes

Mistake #1: Ignoring Income Without 1099-K

Reality Check: Even if you don’t receive a 1099-K form, all business income must be reported if your net earnings exceed $400.

Solution: Maintain comprehensive records regardless of 1099-K receipt.

Mistake #2: Not Tracking Cash Sales

Problem: Many small shops focus only on digital payments.

Best Practice: Record all cash transactions daily in your accounting system.

Mistake #3: Mixing Business and Personal Transactions

Risk: Complicates 1099-K reconciliation and audit risk.

Prevention:

- Use separate business bank accounts

- Obtain dedicated business credit cards

- Never use personal accounts for business transactions

Mistake #4: Poor Inventory Management

Impact: Inaccurate Cost of Goods Sold calculations.

Solution:

Technology Solutions for Small Shops

Recommended Accounting Software

Budget-Friendly Options:

- Wave Accounting: Free with paid payroll

- QuickBooks Simple Start: $15/month

- FreshBooks: $6/month for small shops

Advanced Features:

- Automatic bank reconciliation

- 1099-K form integration

- Inventory management capabilities

- Mobile receipt scanning

Payment Processing Integration

Seamless Data Flow:

- Square: Direct QuickBooks integration

- PayPal: Automatic transaction import

- Stripe: Real-time accounting sync

Planning for 2026 and Beyond

Potential Future Changes

While current thresholds provide relief, stay informed about:

- Congressional discussions on tax policy changes

- State-level reporting requirements

- Platform policy updates affecting small businesses

Building Scalable Systems

Growth Preparation:

- Implement systems that handle increased volume

- Plan for threshold crossing when approaching $20,000

- Consider professional bookkeeping services at $50,000+ revenue

When to Seek Professional Help

Tax Professional Consultation

Consider Professional Assistance For:

- Annual revenue exceeding $75,000

- Complex inventory management needs

- Multiple business entities or partnerships

- 1099-K discrepancies requiring resolution

Year-End Preparation

Professional Services Worth Considering:

- Tax preparation and planning

- Financial statement preparation

- Audit representation if needed

- Business advisory services for growth

Conclusion: Mastering 1099-K in 2025

The 2025 1099-K threshold changes represent a significant win for small shop owners. The reversion to $20,000 plus 200 transactions eliminates unnecessary paperwork for smaller operations while maintaining essential tax compliance frameworks.

Key Action Items for Success:

✅ Maintain comprehensive records: All income must be reported regardless

✅ Implement daily bookkeeping: Consistent record-keeping prevents year-end scrambles

✅ Separate business and personal: Clean financial separation simplifies everything

✅ Plan quarterly payments: Avoid penalties with consistent estimated tax payments

By following this small business guide to handling 1099-K forms in 2025, you’ll maintain compliance, maximize deductions, and focus your energy on growing your business rather than worrying about tax complications.

Ready to streamline your small shop’s financial management? Download our comprehensive bookkeeping templates designed specifically for small retail operations, craft businesses, and service providers.